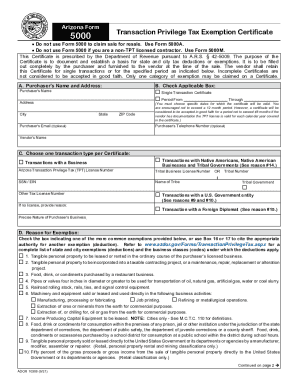

AZ Transaction Privilege Sales and Use free printable template

Show details

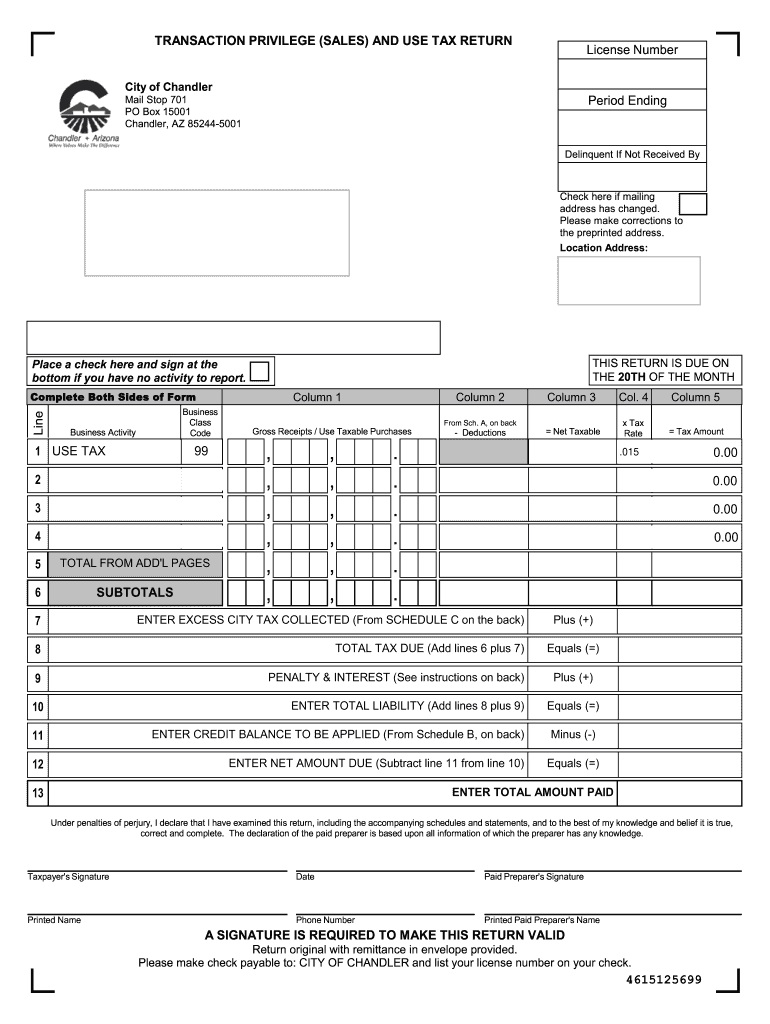

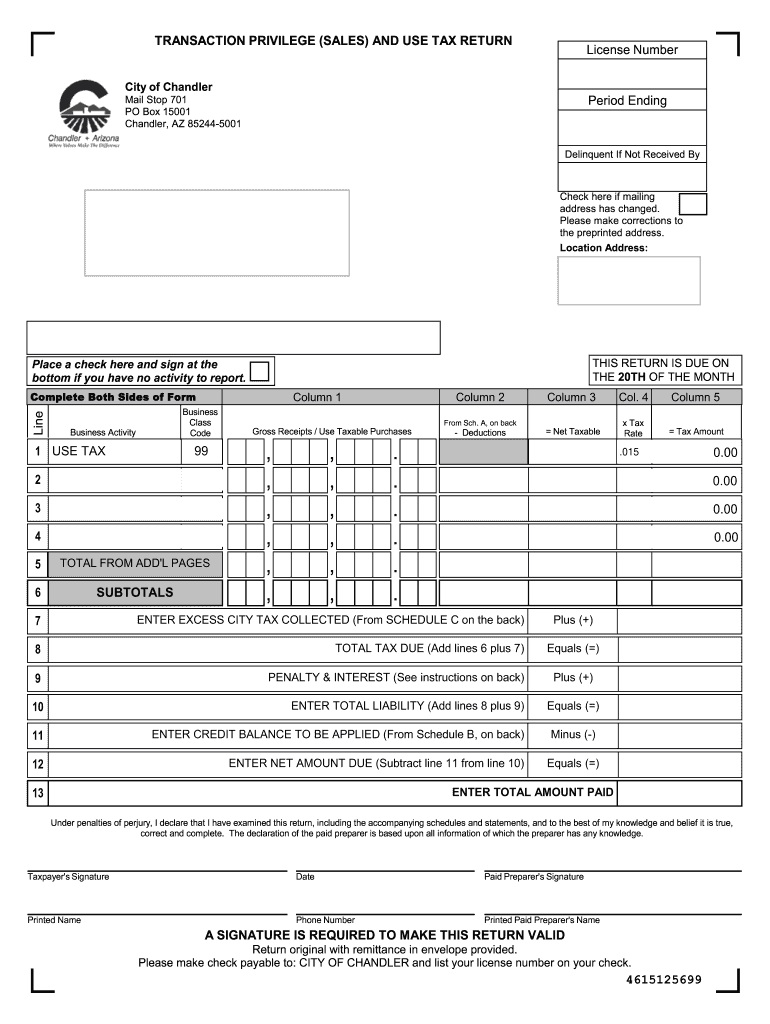

TRANSACTION PRIVILEGE (SALES) AND USE TAX RETURN License Number City of Chandler Period Ending Mail Stop 701 PO Box 15001 Chandler, AZ 85244-5001 Delinquent If Not Received By Check here if mailing

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign chandler city sales tax form

Edit your sales tax license florida form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your quickstart tempe form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sales tax in az online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit arizona sales tax filing form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out chandler sales tax form

How to fill out AZ Transaction Privilege (Sales) and Use Tax

01

Obtain the AZ Transaction Privilege Tax (TPT) form from the Arizona Department of Revenue website.

02

Fill in your business information including name, address, and TPT account number.

03

Specify the type of tax you are reporting (Sales, Use, or both).

04

Include the gross sales amount for the reporting period.

05

Deduct any allowable exemptions or deductions.

06

Calculate the taxable amount by subtracting deductions from gross sales.

07

Apply the appropriate tax rate to the taxable amount to determine the tax owed.

08

Include any applicable local taxes if required.

09

Total any additional fees or credits.

10

Submit the completed form along with any payment to the Arizona Department of Revenue by the due date.

Who needs AZ Transaction Privilege (Sales) and Use Tax?

01

Any business selling tangible goods or services in Arizona.

02

Individuals or businesses making purchases subject to sales or use tax.

03

Retailers and wholesalers operating within Arizona.

04

Out-of-state sellers making sales to Arizona residents.

Fill

form

: Try Risk Free

People Also Ask about

Do you only need to withhold Arizona income tax from employees?

Arizona law requires every employer to withhold Arizona income tax from those employees for services provided within Arizona.

What is the transaction privilege tax in Chandler AZ?

Transaction Privilege (Sales) Tax: The City of Chandler imposes a general tax rate of 1.5%, Restaurant and Bars 1.8%, Utility and Telecommunications 2.75%, and Transient Lodging 2.9%. Privilege tax is imposed on the seller for the privilege of doing business in Chandler.

What is the tax code for Chandler Arizona?

What is the sales tax rate in Chandler, Arizona? The minimum combined 2023 sales tax rate for Chandler, Arizona is 7.8%. This is the total of state, county and city sales tax rates.

How do I find my Arizona transaction privilege tax number?

The location code can be found on the Transaction Privilege Tax (TPT) License Certificate. It is the 3-digit number located on the left side below the address.

What is Arizona transaction privilege tax rate?

2022-1801 decreases the rate of taxation from two and three quarters percent (2.75%) to a rate of two percent (2.00%). This rate change has an effective date of January 1, 2023. Codes on the Transaction Privilege and Other Rate Tables affected by the rate change are listed below.

What is the transaction privilege tax rate in Maricopa County?

Maricopa County adds 0.7% sales tax to support roads and jails. In addition, each city may add sales tax. State of Arizona sales tax (5.6%) and Maricopa County sales tax (0.7%) plus the city sales tax rate equals the amount paid as retail sales tax when purchasing merchandise in that city.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify AZ Transaction Privilege Sales and Use without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your AZ Transaction Privilege Sales and Use into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I edit AZ Transaction Privilege Sales and Use straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing AZ Transaction Privilege Sales and Use.

How do I complete AZ Transaction Privilege Sales and Use on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your AZ Transaction Privilege Sales and Use, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is AZ Transaction Privilege (Sales) and Use Tax?

AZ Transaction Privilege (Sales) and Use Tax is a tax imposed on the privileges of doing business in Arizona. It is essentially a sales tax that is levied on the seller for the privilege of selling tangible personal property, and it encompasses various business activities within the state.

Who is required to file AZ Transaction Privilege (Sales) and Use Tax?

Any business or individual that sells goods or provides taxable services in Arizona is required to file AZ Transaction Privilege (Sales) and Use Tax. This includes retailers, contractors, and other service providers.

How to fill out AZ Transaction Privilege (Sales) and Use Tax?

To fill out the AZ Transaction Privilege (Sales) and Use Tax forms, one must provide information such as total sales, deductions, exemptions, and the calculation of the tax due based on the applicable tax rate for the specific business type.

What is the purpose of AZ Transaction Privilege (Sales) and Use Tax?

The purpose of AZ Transaction Privilege (Sales) and Use Tax is to generate revenue for the state of Arizona to fund various public services, infrastructure, and programs while regulating commercial activity within the state.

What information must be reported on AZ Transaction Privilege (Sales) and Use Tax?

The information that must be reported includes gross income from sales, deductions for exempt sales, the net taxable income, the amount of tax collected, and any applicable credits or penalties.

Fill out your AZ Transaction Privilege Sales and Use online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AZ Transaction Privilege Sales And Use is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.